TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Many are likely looking past the tough transition, to a potentially smoother road ahead.ĭisclosure: Joey Frenette doesn’t own shares of any company mentioned at the time of publication.ĭisclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. A majority of analysts are bullish on the name. If you’re keen on investing in Splunk at this time, you won’t be alone. Regardless, the name isn’t very timely at this juncture, as the transition could continue to make the numbers look weaker over the time being. Splunk’s offering has shown signs of being sticky, and shares may very well march much higher on the other side of the company’s cloud transition. Analyst price targets range from a low of $153 per share, to a high of $210 per share. Out of 22 analyst ratings, there are 16 Buy recommendations, and six Hold recommendations. Wall Street’s TakeĪccording to TipRanks’ analyst rating consensus, SPLK stock comes in as a Moderate Buy.

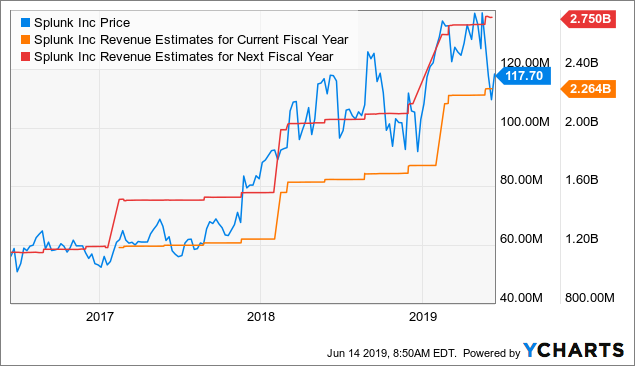

Still, with uncertainty as to when the company will move into sustained profitability, the stock’s rich multiple (shares currently trade at 10.2 times sales), a lack of share price momentum, and significant sales and marketing costs, it might be best to wait on the sidelines for now. Splunk’s clients have shown a willingness to stick around, which bodes well for ARR growth in a competitive environment, as the firm looks to improve and expand its suite of offerings. While the worst of the transition is likely in the rear-view mirror, investors should expect continued volatility as the firm looks to beef up its ARR (Average Recurring Revenues). Respectable growth for a firm that’s continuing to move forward with its transition to the cloud. So, this latest round of results was definitely refreshing for Spunk investors who’ve stayed patient.įor the second quarter, revenue rose 23.2% year-over-year to $605.7 million. Over the past year, it’s been hit or miss for Splunk with regard to quarterly earnings. In late August, Splunk reported a mild earnings beat, with an EPS loss of $0.62, beating the consensus estimate by seven cents. While the stock could prove severely undervalued here, it might be best to take a wait-and-see approach, despite the stock’s large number of Buy ratings from analysts. (See SPLK stock charts on TipRanks)Ī lot is going on behind the scenes at Spunk. Yet, Splunk remains something of a question mark as far as cloud companies go.Īfter yet another rocky year for Splunk stock, and a valuation that looks ever so tempting, I remain neutral on the name.

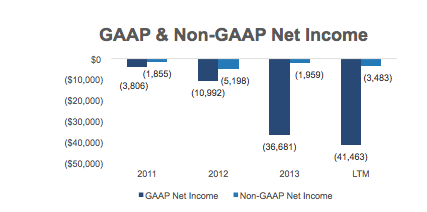

Management did make this clear to investors. Undoubtedly, the company’s transition to a subscription-based cloud data monitoring model has made Splunk’s quarterly results somewhat weaker than they actually were. It went through a painful revenue recognition transition, making it harder for investors and analysts to interpret how the firm has been doing.

SPLUNK STOCK SOFTWARE

Register for your free account today at ( SPLK) is a big-data analytics software play that’s fallen drastically out of favor in recent years. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. ET of the following day.ĭata provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. After Hours trades will be posted from 4:15 p.m.Pre-Market trade data will be posted from 4:15 a.m.will report pre-market and after hours trades. Investors who anticipate trading during these times are strongly advised to use limit orders. Stock prices may also move more quickly in this environment. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. ET) and the After Hours Market (4:00-8:00 p.m. Investors may trade in the Pre-Market (4:00-9:30 a.m.

0 kommentar(er)

0 kommentar(er)